views

Singapore Carbon Credit Market To Grow At Highest Pace Owing To Increasing Afforestation Efforts

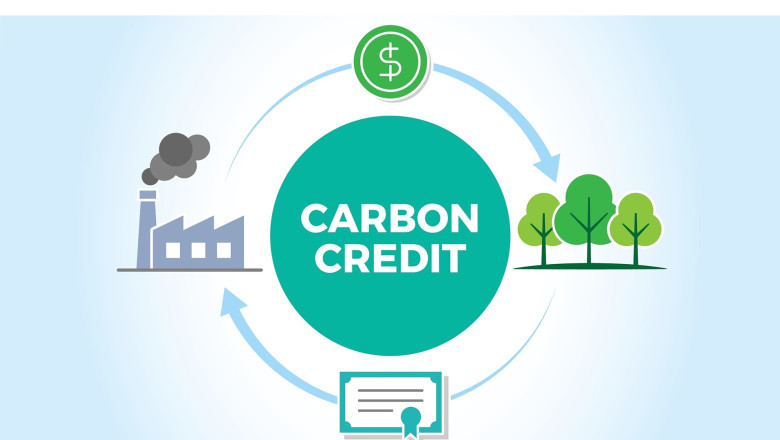

The Singapore carbon credit market comprises trading of carbon credits that provide permission to emit one tonne of carbon dioxide or its equivalent. Carbon credits are generated by projects that reduce or remove greenhouse gas emissions such as renewable energy projects, forestry programs, and waste management. Singapore has adopted an afforestation program to increase its forest cover from 153 km2 in 1967 to 270 km2 in 2031. The planting and preservation of trees helps absorb carbon dioxide from the atmosphere and generate carbon credits.

The Global Singapore Carbon Credit Market Size Is Estimated To Be Valued At US$ 14.5 Mn In 2024 And Is Expected To Exhibit A CAGR Of 21% Over The Forecast Period 2024-2031.

Key Takeaways

Key Players: Key players operating in the Singapore carbon credit market include Climate Impact X, Carbon Credit Capital, Carbonbay, South Pole, And Triple Oxygen. Climate Impact X is the largest carbon credit aggregator in Singapore facilitating trading between project developers and compliance buyers. Carbon Credit Capital and Carbonbay are two leading carbon credit exchange platforms based in Singapore facilitating OTC trading.

Growing Demand: Mandates by the Singapore government to reduce carbon footprint of large corporates and building sector is driving the demand for carbon credits. More than 60% of Singapore's total emissions come from the building and construction sector.

Technological Advancement: Blockchain technology is being increasingly adopted by carbon credit registries and exchanges to bring transparency in project validation and trading. This is reducing documentation errors and counterparty risks.

Market Trends

Transition To Blockchain: Major registries and exchanges are integrating blockchain to digitize carbon credit issuance, tracking, and retirement. This is improving reliability and reducing verification costs.

Focus On Nature-Based Solutions: There is growing focus on blue carbon credits involving mangrove restoration and seagrass projects. These long-term NBS projects help mitigate climate change in a cost-effective manner.

Market Opportunities

Investment In Afforestation Projects: Singapore has ambitious targets to increase its forest cover requiring large investments in sustainable forestation programs that can generate multiple carbon credits over their project lifetime.

Participation Of Smes: Mandates for carbon neutrality are extending to SME sector in Singapore. This is opening up opportunities for carbon credit aggregators to facilitate compliance through high-quality carbon offsetting projects.

Impact Of COVID-19 On Singapore Carbon Credit Market

The outbreak of COVID-19 pandemic has severely impacted the growth of Singapore carbon credit market. During the initial lockdown period, activities in key end-use industries such as manufacturing, power generation, transportation came to a halt which reduced carbon emissions significantly. This lowered the demand and transaction volumes of carbon credits in Singapore in 2020. However, as economic activities resumed post lockdowns in 2021, demand also started picking up again but is yet to reach pre-pandemic levels. The future growth will highly depend on how fast the industries recover from the economic slump caused by the pandemic.

The post-COVID scenario presents both opportunities and challenges for the market. On one hand, with focus on building back better and greener, initiatives to reduce carbon footprint of key industries are expected to increase demand for carbon credits in coming years. Countries are aiming for net-zero emissions by 2050 which will propel the requirements. On the other hand, uncertainties still loom due to possible future virus mutations. The market players need to adopt strategies like diversifying client portfolio, increasing focus on project development in Asia and other high growth markets to mitigate risks. Digitalization of processes for remote verification and transactions can help sustain growth. Collaborating with governments for policy support will fuel investments.

Geographical Regions With Highest Market Concentration

Currently, the Singapore carbon credit market is highly concentrated in the Asia Pacific region, accounting for over 60% of total market value. Within Asia Pacific, China, India, and other Southeast Asian countries dominate the market due to their large manufacturing and industrial bases with carbon-intensive activities. These countries are proactively participating in emission reduction programs and scaling up usage of offsets through carbon credit demand.

Fastest Growing Region

Central and Eastern Europe is poised to be the fastest growing regional market during the forecast period. Countries like Poland and Czech Republic are stepping up climate change mitigation efforts through energy transition and adoption of renewable power. The compliance carbon market is also expanding in the region via the European Union Emissions Trading Scheme. This is attracting many offset project developers towards this high potential region.

What are the key data covered in this Singapore Carbon Credit Market report?

:- Market CAGR throughout the predicted period

:- Comprehensive information on the aspects that will drive the Singapore Carbon Credit Market's growth between 2024 and 2031.

:- Accurate calculation of the size of the Singapore Carbon Credit Market and its contribution to the market, with emphasis on the parent market

:- Realistic forecasts of future trends and changes in consumer behavior

:- Singapore Carbon Credit Market Industry Growth in North America, APAC, Europe, South America, the Middle East, and Africa

:- A complete examination of the market's competitive landscape, as well as extensive information on vendors

:- Detailed examination of the factors that will impede the expansion of Singapore Carbon Credit Market vendors

FAQ’s

Q.1 What are the main factors influencing the Singapore Carbon Credit market?

Q.2 Which companies are the major sources in this industry?

Q.3 What are the market’s opportunities, risks, and general structure?

Q.4 Which of the top Singapore Carbon Credit Market companies compare in terms of sales, revenue, and prices?

Q.5 Which businesses serve as the Singapore Carbon Credit market’s distributors, traders, and dealers?

Q.6 How are market types and applications and deals, revenue, and value explored?

Q.7 What does a business area’s assessment of agreements, income, and value implicate?

Get more insights on this topic: https://www.ukwebwire.com/singapore-carbon-credit-market-growth-size-and-demand/

Comments

0 comment